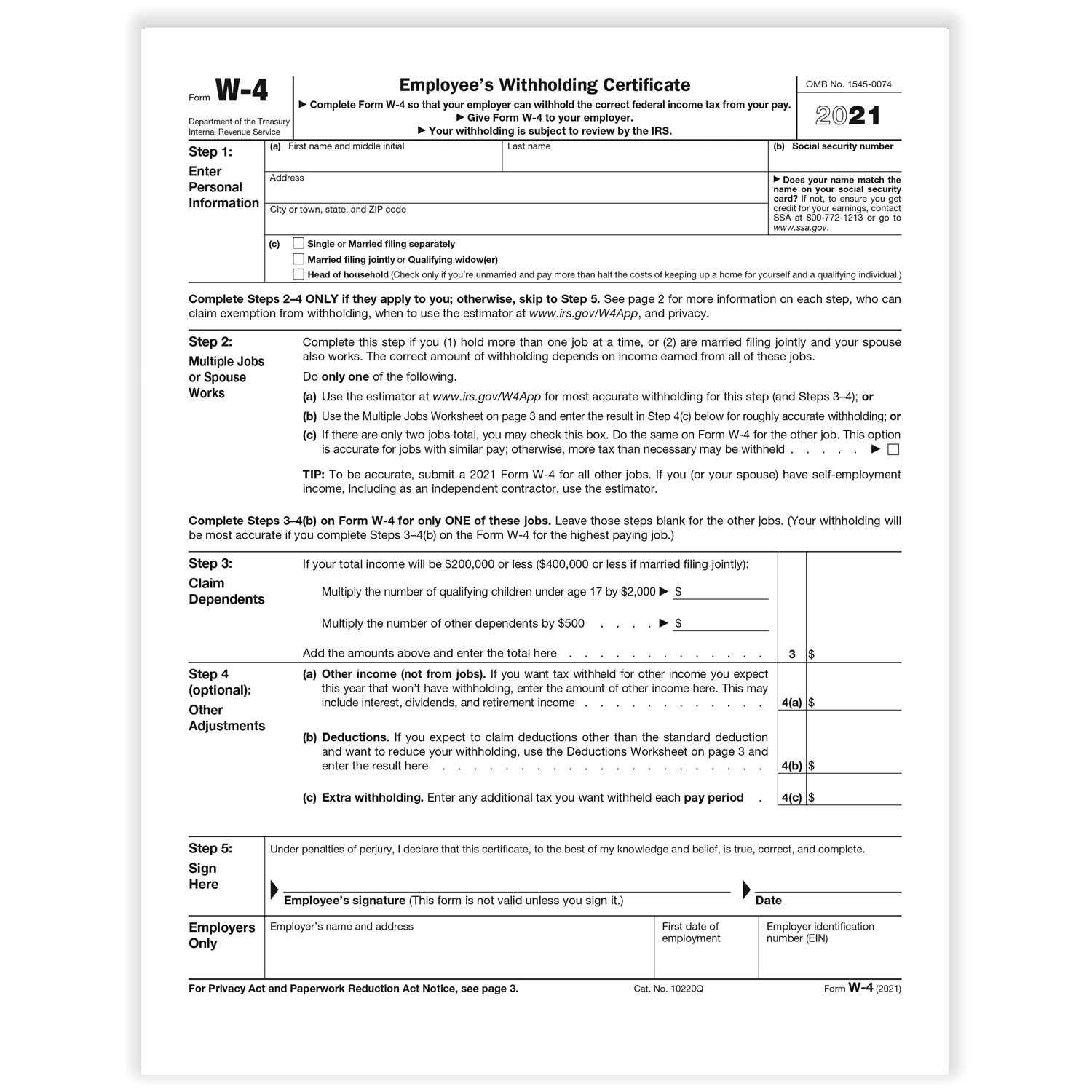

The Internal Revenue Service (IRS) has recently released the new 2021 version of the W-4 form. This form is used to determine the amount of federal income tax that an employer should withhold from an employee’s paycheck. It’s important to ensure that this form is filled out correctly to avoid under or overpaying taxes.

2021 Printable Irs Forms W-4

The new W-4 form has been updated to reflect changes made by the Tax Cuts and Jobs Act in 2017, which altered the tax brackets and deductions available. The main difference between the new and old forms is the elimination of withholding allowances and the introduction of a five-step process to calculate withholding amounts.

The new W-4 form has been updated to reflect changes made by the Tax Cuts and Jobs Act in 2017, which altered the tax brackets and deductions available. The main difference between the new and old forms is the elimination of withholding allowances and the introduction of a five-step process to calculate withholding amounts.

The first step involves entering personal information such as name, address, and filing status. The next step requires inputting dependents and additional income if applicable. The third step involves identifying additional withholding amounts if necessary, such as for multiple jobs or a spouse’s income.

The fourth step allows the employee to claim exemptions for child or dependent care expenses, or other deductions. The final step involves signing the form to confirm the accuracy of the information provided.

Importance of Accurate Filling

It’s crucial to fill out the W-4 form accurately to avoid over or underpaying taxes. Underpaying can result in penalties and interest charges for the employee. On the other hand, overpaying taxes can result in an interest-free loan to the government and reduce the employee’s cash flow.

It’s crucial to fill out the W-4 form accurately to avoid over or underpaying taxes. Underpaying can result in penalties and interest charges for the employee. On the other hand, overpaying taxes can result in an interest-free loan to the government and reduce the employee’s cash flow.

It’s recommended that employees review their withholding amounts annually, especially if significant changes occur such as marriage or children. This ensures that the amount withheld from paychecks aligns with their tax liability and reduces surprises during tax season.

Conclusion

The new 2021 W-4 form simplifies the withholding process but requires accurate information to avoid tax errors. Completing this form correctly is essential to ensure accurate tax withholding amounts and avoid penalties or interest charges for underpayment. Employees should review their withholdings annually, especially if significant life changes occur.

The new 2021 W-4 form simplifies the withholding process but requires accurate information to avoid tax errors. Completing this form correctly is essential to ensure accurate tax withholding amounts and avoid penalties or interest charges for underpayment. Employees should review their withholdings annually, especially if significant life changes occur.

Remember, accurate and timely completion of tax forms is a responsibility for every employee. For more information and guidance on completing tax forms, refer to the instructions provided by the federal agency.