If you’re someone who is in the market for a loan, you may have heard the term “amortization schedule” thrown around. But what exactly does it mean? And why is it important?

Understanding Amortization

Put simply, amortization is the process of paying off a debt over time through regular payments. These payments typically consist of both principal (the amount borrowed) and interest (the cost of borrowing).

An amortization schedule breaks down your payments over the life of the loan, showing you how much of each payment goes toward principal and how much goes toward interest. This can be helpful in understanding the true cost of a loan and in planning your budget to ensure that you can make your payments on time.

Why Use an Amortization Schedule?

There are a few key reasons why you might want to use an amortization schedule when taking out a loan:

- Helps You Understand the True Cost of a Loan: An amortization schedule can help you better understand the total cost of a loan, including both principal and interest. This can help you determine whether a particular loan is affordable and in line with your financial goals and needs.

- Can Help You Budget for Your Loan Payments: By breaking down your payments into a schedule, an amortization schedule can help you plan your budget so that you can make your payments on time each month.

- Can Help You Choose between Different Loan Options: If you’re trying to decide between multiple loan options, an amortization schedule can help you compare the total cost and payment schedule for each option, making it easier to choose the right one for you.

Using an Amortization Schedule Template

If you’re interested in using an amortization schedule to help you manage your loan payments, you don’t need to create one from scratch. There are many free templates available online that you can use as a starting point.

Free Amortization Schedule Template

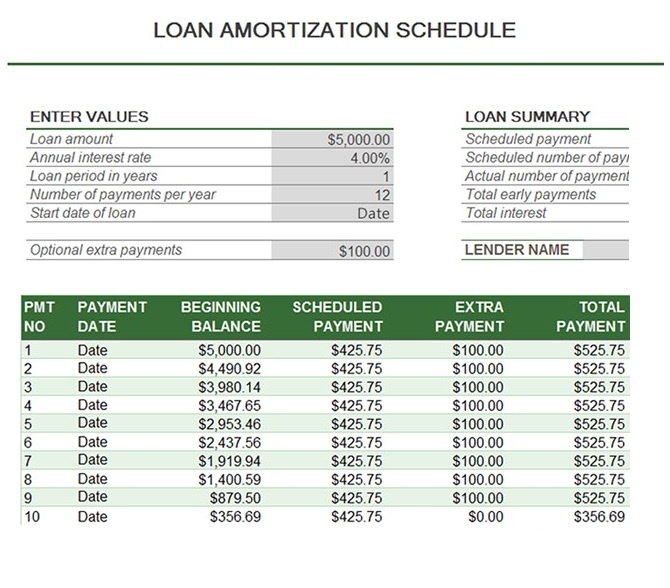

This amortization schedule template is easy to use and can help you understand the cost of your loan over time. Simply enter your loan amount, interest rate, and term (in months), and the template will do the rest!

This amortization schedule template is easy to use and can help you understand the cost of your loan over time. Simply enter your loan amount, interest rate, and term (in months), and the template will do the rest!

The template will give you a breakdown of each monthly payment, including both principal and interest, as well as the remaining balance on the loan. This can be helpful in understanding your total debt and in planning your budget to ensure that you can make your payments on time each month.

Tips for Using an Amortization Schedule

Here are a few tips to keep in mind when using an amortization schedule:

- Make Sure You Enter Accurate Information: To get the most accurate results, make sure you enter all of your loan information correctly, including the loan amount, interest rate, and term.

- Remember to Account for Extra Payments: If you plan on making extra payments (such as lump sum payments or additional payments each month), make sure to account for these in your amortization schedule to see how they will impact your total cost.

- Update Your Budget as Needed: As you make payments on your loan, make sure to update your budget to reflect the new payment amounts. This will help you stay on track and avoid missing payments, which can result in late fees and damage to your credit score.

Conclusion

An amortization schedule can be a helpful tool for anyone who is taking out a loan. By breaking down your payments into a schedule, you can better understand the total cost of the loan and plan your budget accordingly. And with free templates available online, it’s easy to get started!