It’s tax season again, and that means one thing - it’s time to fill out Form 1040. If you’re not a tax expert, the process can seem daunting. But don’t worry, we’re here to break it down for you.

What is Form 1040?

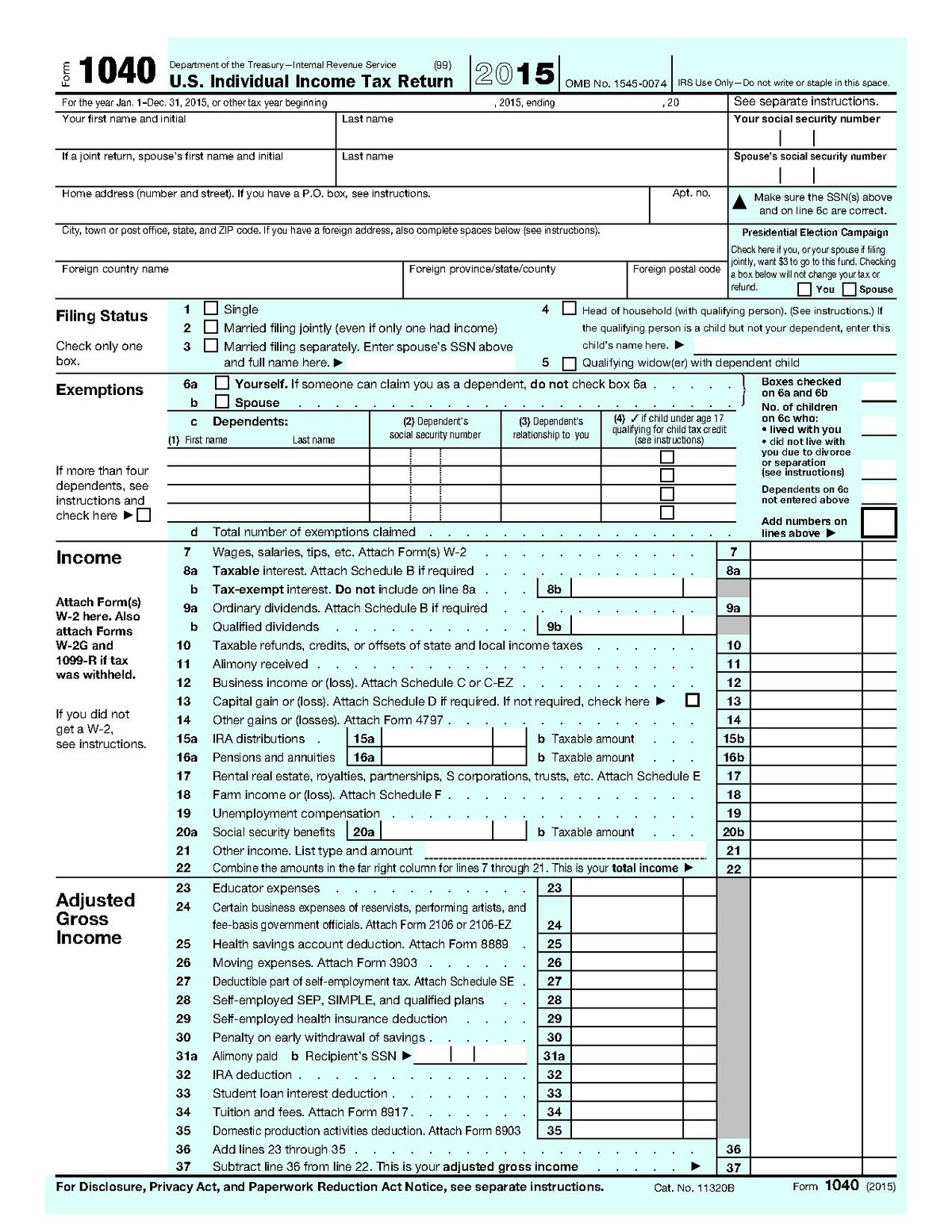

Form 1040 is the standard Internal Revenue Service (IRS) form that individuals use to file their annual income tax returns. It includes information on your income, deductions, credits, and taxes owed. Essentially, it’s a summary of your financial activities throughout the year.

Form 1040 is the standard Internal Revenue Service (IRS) form that individuals use to file their annual income tax returns. It includes information on your income, deductions, credits, and taxes owed. Essentially, it’s a summary of your financial activities throughout the year.

Why is it important?

Filing your taxes is not only a legal requirement, it’s also an opportunity to claim deductions and credits that can help reduce your tax liability. These deductions and credits can range from childcare expenses to student loan interest, depending on your individual situation.

How do I fill out Form 1040?

While the form can seem complicated at first, it’s important to take your time and fill it out accurately. Here are the basic steps:

1. Gather your documents

Before you start filling out Form 1040, you’ll need to gather all the necessary documents, including:

- W-2s from all employers

- 1099s for any freelance or contract work

- Receipts for any deductions or credits you plan to claim

2. Follow the instructions

Form 1040 comes with a set of instructions that provide guidance on how to fill out each section. Be sure to read the instructions carefully and follow them step by step. If you have any questions, don’t hesitate to reach out to a tax professional.

3. Double-check your work

Before you submit your tax return, it’s important to double-check all your information for accuracy. This includes making sure your math is correct and that you’ve included all necessary forms and schedules.

What are some common mistakes to avoid?

1. Filing late

The deadline to file your tax return is typically April 15th. Failing to file on time can result in penalties and interest charges that can add up quickly.

2. Failing to report all income

Make sure you report all income, including freelance and contract work. Failing to report all income can result in penalties and interest charges.

3. Math errors

Make sure you double-check your math to avoid errors that could result in penalties or a delay in receiving your refund.

The Bottom Line

While filling out Form 1040 can seem overwhelming, it’s an important part of being a responsible citizen and making sure you’re paying your fair share of taxes. By following the instructions carefully and double-checking your work, you can ensure that your tax return is accurate and that you’re claiming all deductions and credits that you’re eligible for.